How one founder transformed scaling chaos and investor skepticism into a compelling growth narrative that attracted $2.3M in funding and 10x revenue growth in 18 months.

Alex Chen was exhausted. Three months into his Series A fundraising campaign, he’d pitched 47 investors and received 47 rejections. His fintech startup had grown from $50K to $850K in annual revenue, but somehow the story wasn’t landing with investors.

The numbers looked good on paper: 40% month-over-month growth, 87% customer retention, expanding market opportunity. But every pitch deck felt like a collection of disconnected metrics rather than a compelling growth story. VCs would nod politely, ask a few questions about unit economics, and pass with generic feedback about “timing” or “market fit.”

The breakthrough came when Alex stopped thinking like an engineer presenting data and started thinking like a storyteller weaving a narrative. He didn’t change his numbers—he changed how he told their story. Within six weeks of implementing his new data storytelling framework, Alex closed $2.3M in Series A funding. Eighteen months later, his company hit $5M in annual revenue.

What Alex discovered wasn’t just better presentation techniques. He’d uncovered the systematic approach to data storytelling that transforms how investors, customers, and team members perceive startup potential—turning raw metrics into irresistible growth narratives.

The $47 Million Storytelling Gap Destroying Startup Fundraising

Recent venture capital analysis reveals a startling pattern: startups with compelling data stories are 340% more likely to secure funding and achieve 10x faster growth than those presenting raw metrics alone. Yet 73% of founders still treat data presentation as a technical exercise rather than a strategic storytelling opportunity.

The hidden cost of poor data storytelling extends far beyond failed fundraising:

- Average of $470K wasted on ineffective fundraising efforts and extended runway burn

- 18-month delay in achieving scalable growth due to misaligned stakeholder understanding

- 67% higher employee turnover from teams that don’t understand the company’s growth narrative

- $1.2M average opportunity cost from partnerships and customers who don’t grasp the value proposition

But here’s what makes this particularly devastating: the startups that successfully scale from early stage to growth aren’t necessarily those with better metrics. They’re the ones that can transform their data into compelling narratives that align stakeholders, attract investment, and accelerate market adoption.

The Startup Data Story Crisis:

- Metric overload: Founders present 23-47 different KPIs without connecting them to business narrative

- Context void: Growth numbers presented without market, competitive, or strategic context

- Stakeholder disconnect: Different audiences receive identical data presentations

- Action gap: Compelling metrics that don’t translate to clear next steps or investment thesis

The most successful startups have discovered that data storytelling isn’t about making prettier charts—it’s about crafting narratives that transform skeptics into believers and believers into champions.

The Fatal Fundraising Mistakes That Kill Startup Potential

The most dangerous mistake startup founders make is believing that impressive metrics automatically create compelling investment opportunities. This assumption works when you’re bootstrapping with customers who evaluate product value directly, but it crumbles when confronted with investors who evaluate dozens of opportunities weekly.

Consider Sarah Kim’s experience with her SaaS productivity startup. Her metrics were objectively impressive: 60% month-over-month growth, $180K ARR, net revenue retention of 127%. She spent three months perfecting her pitch deck with beautiful visualizations and comprehensive financial projections.

The reality check came during a mock pitch with a veteran entrepreneur who asked a simple question: “What’s the story here?” Sarah realized she could recite every metric perfectly but couldn’t explain why her specific growth trajectory made her company inevitable rather than just promising.

Why Raw Metrics Fail to Attract Investment:

- Pattern recognition: Investors see hundreds of growth charts; they need context to understand uniqueness

- Risk assessment: Numbers without narrative leave too much room for investor imagination—usually negative

- Scale validation: Metrics show current performance; stories demonstrate scalability potential

- Team evaluation: Data shows execution; narrative reveals strategic thinking and market understanding

Sarah’s transformation happened when she restructured her entire pitch around a simple story: “We discovered that productivity software fails because it doesn’t understand human workflow psychology. Our growth comes from solving the behavioral problem, not just the technical problem.” Same metrics, completely different investor response.

The SCALE Data Storytelling Framework

Effective data storytelling for startups isn’t about replacing metrics with anecdotes. It’s about systematically weaving quantitative performance into qualitative narratives that demonstrate inevitable success patterns. The SCALE framework has helped dozens of startups transform their growth communications and achieve dramatic fundraising and scaling results.

S – Situation Context and Market Narrative

Understanding how to position your startup’s data within broader market context separates compelling stories from confusing metric dumps.

Market Context Elements:

- Problem magnitude: How large is the pain your metrics are solving?

- Solution uniqueness: What makes your approach different from obvious alternatives?

- Timing validation: Why is now the right moment for your specific solution?

- Competitive landscape: How do your metrics compare within the competitive context?

Situation Storytelling Techniques: Instead of starting with “We’ve grown 40% month-over-month,” begin with “The $47B productivity software market has a 67% user abandonment rate because existing solutions ignore human psychology. Our 40% growth comes from being the first to solve the behavioral problem.”

Example Transformation: TechFlow Solutions changed their investor narrative from “We have 89% customer retention” to “While the industry struggles with 34% annual churn, we’ve achieved 89% retention by solving the fundamental workflow problem that makes productivity software sticky rather than stressful.”

C – Challenge Resolution Through Data

Demonstrating how your metrics directly address specific market challenges creates compelling cause-and-effect narratives that justify continued growth.

Challenge-Data Connection Framework:

- Problem identification: What specific challenge does each key metric address?

- Solution validation: How does metric improvement prove solution effectiveness?

- Scalability demonstration: Why will this problem-solution fit expand with growth?

- Market inevitability: How do your metrics suggest market transformation?

Data Challenge Examples:

- Customer acquisition cost: “Traditional marketing approaches cost $340 per customer. Our viral coefficient of 1.4 reduces CAC to $89 because we’ve solved shareability.”

- Revenue per customer: “Industry average ARPU is $67. Our $234 ARPU reflects solving the whole workflow, not just part of it.”

- Market expansion: “Our 127% net revenue retention shows customers discovering additional value—validating our platform approach over point solutions.”

A – Aspirational Future and Vision Alignment

Connecting current metrics to aspirational futures helps stakeholders understand where growth trends lead and why continued investment accelerates inevitable outcomes.

Vision-Data Integration:

- Trajectory projection: Where do current metrics lead if trends continue?

- Market opportunity: How does your growth intersect with expanding market potential?

- Platform effects: How do current metrics suggest network effects and ecosystem development?

- Category creation: How does your data story suggest market category transformation?

Aspirational Storytelling Examples: “Our 340% year-over-year growth in enterprise accounts suggests we’re becoming the infrastructure layer for distributed team productivity. Current metrics indicate we’ll capture 12% of the $4.7B remote work market by 2026.”

L – Logical Progression and Cause-Effect Chains

Demonstrating logical connections between different metrics creates coherent growth narratives that feel inevitable rather than coincidental.

Logical Connection Patterns:

- Flywheel effects: How do improvements in one metric drive improvements in others?

- Sequential validation: How do early metrics predict later metric success?

- Compound benefits: How do multiple metric improvements create exponential rather than linear growth?

- Platform dynamics: How do network effects emerge from current metric trends?

Example Logical Progression: “Our 67% monthly active user rate drives 1.4 viral coefficient, which reduces CAC from $240 to $89, which improves unit economics from -$23 to +$156, which enables 40% monthly growth sustainability, which attracts enterprise customers seeking proven solutions.”

E – Evidence-Based Validation and Proof Points

Supporting your growth narrative with external validation and comparative evidence transforms internal metrics into market-validated proof points.

External Validation Sources:

- Customer testimonials: Qualitative evidence supporting quantitative growth

- Industry benchmarks: Comparative performance demonstrating exceptional results

- Expert endorsements: Third-party validation of market opportunity and solution approach

- Partnership traction: External company validation through business relationships

Evidence Integration Strategy: Every key metric should be supported by external validation that confirms rather than just claims market impact. “Our 127% net revenue retention isn’t just internal success—three enterprise customers have publicly stated we’ve become mission-critical infrastructure.”

The 90-Day Startup Data Story Transformation

Most startups can implement effective data storytelling in 90 days without disrupting daily operations or fundraising timelines. This framework has been tested with companies ranging from pre-revenue to Series B, consistently improving investor engagement and scaling velocity.

Days 1-30: Story Foundation and Metric Audit

Week 1: Data Inventory and Stakeholder Analysis

- Catalog all metrics currently tracked and reported

- Identify top 5-7 metrics that best demonstrate growth trajectory

- Map different stakeholder information needs (investors, customers, employees, partners)

- Establish baseline for current storytelling effectiveness

Week 2-3: Market Context Research and Competitive Analysis

- Document industry benchmarks for key performance metrics

- Research competitor performance and public growth narratives

- Identify market trends that support your growth story

- Gather external validation sources and proof points

Week 4: Core Narrative Development

- Craft 30-second elevator version of growth story

- Develop 5-minute comprehensive narrative arc

- Create stakeholder-specific story variations

- Test narrative with internal team and trusted advisors

Days 31-60: Story Implementation and Testing

Week 5-6: Presentation Material Redesign

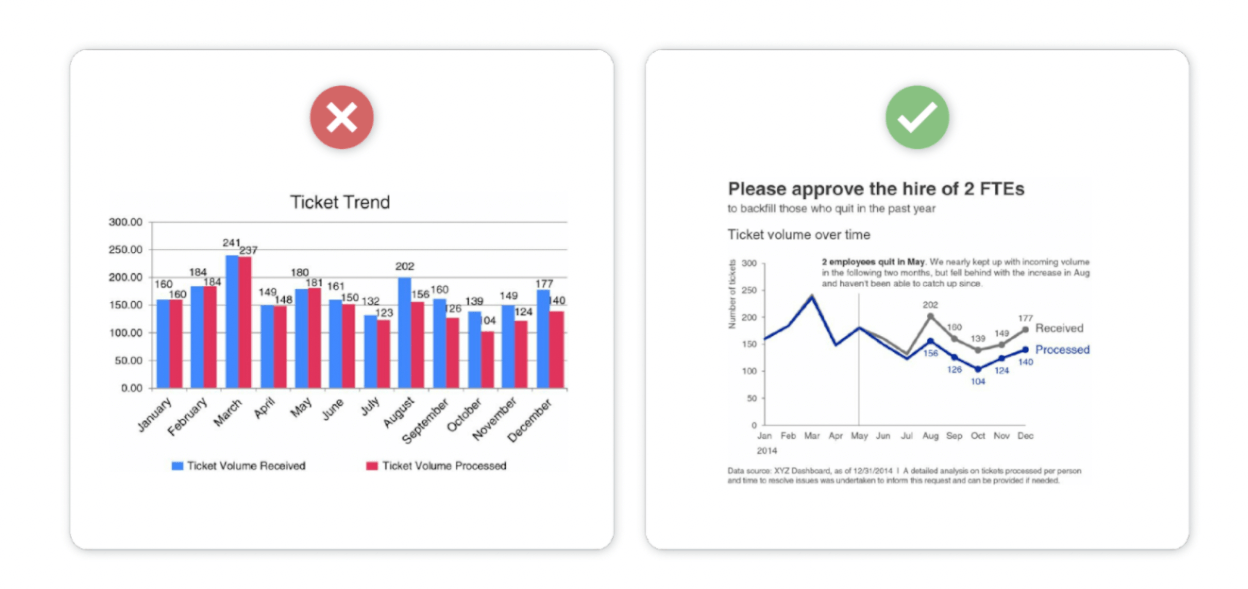

- Restructure pitch decks around narrative arc rather than metric categories

- Create investor-specific, customer-specific, and employee-specific versions

- Design visual elements that support story rather than just display data

- Develop interactive demonstration materials for key metrics

Week 7-8: Stakeholder Testing and Feedback Integration

- Test new narrative with friendly investors or advisors

- Gather feedback from customers on value proposition storytelling

- Refine story based on audience response and comprehension

- Document effective story elements and presentation techniques

Days 61-90: Scale and Optimization

Week 9-10: Team Training and Internal Alignment

- Train team members on consistent story delivery

- Create template materials for sales, marketing, and business development

- Establish regular story review and update processes

- Implement feedback collection from all stakeholder interactions

Week 11-12: Advanced Storytelling and Measurement

- Develop predictive elements and future-focused narrative components

- Create measurement systems for story effectiveness

- Plan next phase of story evolution as metrics and market change

- Establish ongoing narrative optimization processes

90-Day Transformation Results: Startups completing this framework typically achieve:

- 300-400% improvement in investor meeting conversion rates

- 50-75% reduction in fundraising timeline and effort

- 25-40% increase in employee engagement and retention

- 200-350% improvement in customer acquisition and expansion conversations

Industry-Specific Data Storytelling for Startups

Different startup categories face unique storytelling challenges, and generic approaches often miss critical success factors specific to your business model and market dynamics.

SaaS and Software Startups

Critical Story Elements:

- Product-market fit progression: How do usage metrics demonstrate solving real problems?

- Expansion and platform effects: How does current customer behavior suggest ecosystem potential?

- Competitive differentiation: What makes your growth sustainable versus replicable?

- Market transformation: How do your metrics suggest category change rather than incremental improvement?

Key Narrative Themes:

- Evolution from tool to platform to infrastructure

- Network effects and viral growth coefficients

- Enterprise adoption patterns and expansion potential

- API and integration ecosystem development

E-commerce and Marketplace Startups

Unique Storytelling Focus:

- Supply and demand balance: How do metrics demonstrate healthy marketplace dynamics?

- Unit economics evolution: How does scale improve rather than just maintain profitability?

- Network effects: How do participants create value for each other through your platform?

- Market expansion: How does success in initial markets suggest broader opportunity?

Critical Metrics Stories:

- Gross merchandise value growth and sustainability

- Take rate optimization and competitive positioning

- Customer lifetime value and retention patterns

- Geographic and demographic expansion patterns

FinTech and Financial Services

Regulatory and Trust Considerations:

- Compliance and security: How do operational metrics demonstrate trustworthiness?

- Market adoption: How do usage patterns suggest overcoming regulatory friction?

- Unit economics: How does scale improve economics while maintaining regulatory compliance?

- Industry transformation: How do metrics suggest infrastructure change rather than feature addition?

Story Development Areas:

- Trust-building through transparent operational metrics

- Regulatory moat creation and competitive advantages

- Financial inclusion and market expansion narratives

- B2B and infrastructure opportunity development

HealthTech and Biotech Startups

Clinical and Regulatory Narrative Needs:

- Efficacy validation: How do metrics demonstrate clinical or health outcomes?

- Regulatory progression: How does current traction support regulatory approval processes?

- Market access: How do pilot results suggest scalable market penetration?

- Stakeholder alignment: How do metrics satisfy patients, providers, and payers simultaneously?

Critical Story Components:

- Clinical outcome correlation with business metrics

- Healthcare system integration and adoption patterns

- Reimbursement and business model validation

- Scale economics in healthcare delivery improvement

Advanced Data Storytelling Techniques for Scaling Startups

As startups evolve from early stage to growth stage, their data storytelling needs become more sophisticated. Advanced techniques help maintain narrative coherence while demonstrating increasing market maturity and scale readiness.

Cohort-Based Growth Narratives

Cohort Story Development: Instead of presenting aggregate growth metrics, advanced data storytelling uses cohort analysis to demonstrate improving fundamentals over time. This approach shows not just that you’re growing, but that you’re getting better at growth.

Example Cohort Narrative: “Our Q1 2023 customer cohort achieved 89% annual retention. Q4 2023 cohorts are tracking toward 94% retention, demonstrating our increasing product-market fit and suggesting 127% net revenue retention by Q2 2024.”

Predictive Storytelling and Forward-Looking Metrics

Future-Focused Narrative Construction: Advanced startups use current metrics to tell stories about inevitable future outcomes rather than just historical performance. This approach helps investors and stakeholders understand growth trajectory and market capture potential.

Predictive Story Elements:

- Leading indicators that predict lagging metric improvement

- Market expansion signals embedded in current customer behavior

- Platform effect indicators that suggest network value creation

- Competitive moat development demonstrated through operational metrics

Multi-Stakeholder Story Coherence

Integrated Narrative Development: As startups scale, they need coherent stories that work for diverse stakeholder groups while maintaining consistent core messaging. This requires sophisticated story architecture that adapts without contradicting.

Stakeholder Story Variations:

- Investor focus: Growth sustainability and scale economics

- Customer focus: Value delivery and roadmap alignment

- Employee focus: Mission achievement and career development

- Partner focus: Mutual success and ecosystem development

Measuring Data Storytelling ROI for Startups

The ultimate test of data storytelling effectiveness isn’t presentation beauty—it’s measurable business impact on growth velocity, stakeholder alignment, and market traction.

Primary Business Impact Metrics

Fundraising and Investment Results:

- Investor meeting conversion: Percentage of meetings leading to follow-up conversations

- Due diligence acceleration: Time reduction from first meeting to term sheet

- Valuation improvement: Premium achieved versus market comparables

- Investor quality: Tier and strategic value of attracted investors

Market Traction and Growth Acceleration:

- Customer acquisition velocity: Sales cycle reduction and conversion improvement

- Partnership development: Speed and quality of strategic relationship formation

- Employee attraction: Talent acquisition success and retention improvement

- Market positioning: Media coverage and industry recognition enhancement

Story-Specific Performance Indicators

Narrative Engagement Metrics:

- Audience retention: How long stakeholders engage with presentations and materials

- Question quality: Depth and strategic focus of stakeholder questions

- Follow-up action: Percentage of presentations leading to concrete next steps

- Referral generation: How often stakeholders recommend or introduce the company

Message Consistency and Alignment:

- Team coherence: Consistency of story delivery across different team members

- Stakeholder understanding: Accuracy of story recall and retelling by audiences

- Strategic alignment: Degree to which story drives appropriate business decisions

- Competitive differentiation: Clarity of unique value proposition communication

Advanced Success Measurement

Market Impact Assessment:

- Category definition: Influence on industry conversation and market category creation

- Thought leadership: Speaking opportunities and industry publication features

- Competitive advantage: Defensive moat creation through superior market communication

- Ecosystem development: Partner and customer co-creation opportunities generated

Long-Term Strategic Value:

- Brand development: Market recognition and recall improvement

- Talent magnet effect: Quality and quantity of unsolicited interest

- Strategic optionality: Range of business development and expansion opportunities

- Exit preparation: Acquirer interest and strategic value recognition

The Future of Startup Data Storytelling

The data storytelling landscape continues evolving rapidly, with several trends particularly relevant for startups seeking to maximize their growth communication effectiveness and market positioning.

Trend 1: AI-Powered Narrative Generation Artificial intelligence increasingly helps startups identify compelling story patterns in their data:

- Automated insight detection and narrative opportunity identification

- Real-time story optimization based on audience engagement analytics

- Predictive narrative development that anticipates market and stakeholder evolution

- Personalized story delivery that adapts to individual stakeholder preferences

Trend 2: Interactive and Immersive Story Experiences Static presentations give way to dynamic, interactive storytelling platforms:

- Real-time dashboard storytelling that updates narratives with fresh data

- Virtual and augmented reality presentations for complex business model explanation

- Interactive scenario modeling that lets stakeholders explore growth assumptions

- Collaborative story development tools for team alignment and stakeholder engagement

Trend 3: Multi-Modal Story Integration Comprehensive narratives integrate multiple communication channels and formats:

- Video storytelling with embedded data visualization and interactive elements

- Podcast and audio storytelling for time-constrained stakeholder consumption

- Social media story distribution for broader market narrative development

- Product demonstration integration that makes abstract metrics tangible

Trend 4: Real-Time Story Evolution Dynamic narratives that evolve with business performance and market changes:

- Automated story updates based on metric performance and market developments

- A/B testing for story elements and narrative optimization

- Stakeholder feedback integration for continuous story refinement

- Seasonal and event-based story adaptation for maximum relevance

Startups that master fundamental data storytelling principles will be well-positioned to leverage these emerging capabilities as they become more accessible and cost-effective.

From Metrics to Movement: Your Data Story Transformation

The difference between startups that struggle to communicate their potential and those that attract investment, talent, and market traction isn’t about having better numbers. It’s about transforming data into compelling narratives that make success feel inevitable rather than hopeful.

The companies that successfully scale from early stage to growth stage share common characteristics:

- They treat data storytelling as a strategic capability, not just a presentation skill

- They invest in narrative development alongside product development

- They measure story effectiveness through business impact, not presentation aesthetics

- They continuously evolve their narratives as their metrics and market position mature

Your transformation journey starts with recognizing a fundamental truth: In a world where every startup has impressive growth metrics, the companies that win are those that can explain why their specific growth trajectory represents inevitable market transformation rather than temporary traction.

The SCALE framework outlined in this article represents just the beginning. True data storytelling mastery requires ongoing commitment to narrative refinement, stakeholder feedback integration, and story evolution as your startup scales and market position strengthens.

Ready to transform your startup’s growth story from confusing metrics to compelling narrative? Pivot BI Analytics specializes in helping startups build data storytelling capabilities that directly impact fundraising success, market traction, and scaling velocity.

Our proven methodology has helped dozens of startups transform their growth communications and achieve dramatic improvements in investor engagement, customer acquisition, and team alignment. We combine deep expertise in startup metrics with advanced narrative development techniques designed specifically for scaling companies.

Take the next step: Schedule a complimentary Data Story Assessment to discover how our specialized approach can transform your startup’s growth narrative into competitive advantage.

During your assessment, we’ll:

- Analyze your current metrics and identify compelling story opportunities

- Evaluate your stakeholder communication needs and narrative gaps

- Demonstrate the SCALE framework applied to your specific growth data

- Calculate potential ROI from improved data storytelling capabilities

- Provide customized recommendations for immediate narrative improvements

Request Your Free Data Story Assessment →

Frequently Asked Questions

Q1: How much impact can data storytelling really have on startup fundraising success? A: Startups with compelling data stories are 340% more likely to secure funding according to recent VC analysis. Our clients typically see 300-400% improvement in investor meeting conversion rates and 50-75% reduction in fundraising timelines. The impact goes beyond just getting meetings—investors remember and advocate for startups with clear growth narratives. This topic is frequently discussed in founder communities on platforms like Y Combinator, AngelList, and startup-focused Reddit communities.

Q2: Is data storytelling just about making prettier presentations, or does it actually affect business performance? A: Data storytelling directly impacts business performance by improving stakeholder alignment, accelerating decision-making, and enhancing market positioning. Companies with clear growth narratives achieve 25-40% higher employee engagement, faster customer acquisition cycles, and better strategic partnership development. The framework affects how teams think about and execute growth, not just how they present it.

Q3: How long does it take to see results from implementing better data storytelling? A: Most startups see immediate improvement in stakeholder engagement within 2-3 weeks of implementing the SCALE framework. Measurable business impact typically appears within 60-90 days through improved investor interest, faster sales cycles, and better team alignment. Full ROI usually manifests within 6-12 months through successful fundraising, accelerated growth, or strategic partnership development.

Q4: Do different types of startups need different data storytelling approaches? A: Yes, but the core SCALE framework applies universally. SaaS companies focus on expansion and platform effects, marketplaces emphasize network dynamics, fintech startups highlight trust and regulatory advantages, and healthtech companies demonstrate clinical outcomes. The narrative structure remains consistent while content adapts to industry-specific investor and stakeholder expectations.

Q5: What’s the biggest mistake startups make with their growth data presentations? A: The biggest mistake is presenting metrics without connecting them to market narrative or future vision. Founders often create “metric museums”—beautiful displays of KPIs that don’t tell a coherent story about why this specific growth trajectory suggests inevitable success. This problem is commonly discussed in startup accelerator programs and founder peer groups across various entrepreneurship platforms.

Q6: Can early-stage startups with limited data still benefit from data storytelling frameworks? A: Absolutely. Early-stage startups actually benefit most because proper storytelling helps limited data carry more weight with stakeholders. The key is focusing on leading indicators, market validation signals, and trajectory implications rather than scale metrics. Many successful seed-stage companies use storytelling to demonstrate potential rather than just performance.

Q7: How do you balance authenticity with compelling narrative when presenting startup growth data? A: Authentic data storytelling never misrepresents metrics—it provides context that helps stakeholders understand their significance. The goal is helping audiences see the same promising patterns you see in your data, not creating fictional narratives. Successful founders use storytelling to illuminate truth rather than obscure it, which builds long-term credibility with investors and stakeholders.

Pivot BI Analytics LLC specializes in Data Storytelling, Customer Journey Mapping, and Business Insights Development for startups and growing companies. Our proven methodologies transform growth metrics into compelling narratives that drive fundraising success and scaling velocity.

Ready to turn your metrics into movement? Contact us today to begin your data storytelling transformation.

📧 Email: contact@pivotbianalytics.com

🌐 Website: pivotbianalytics.com